business insurance credit score vehicle dui

business insurance credit score vehicle dui

If you have a brand-new chauffeur in your family, you may wonder just how much it will certainly cost to include a teen to your automobile insurance coverage plan - cheaper auto insurance. While including a teenage will raise your premiums, it will set you back a lot less than the expense of an independent plan for a teen driver.

In various other situations, your teenager will be covered under your policy till they transform 18 or have a complete certificate. The Price of Teen Automobile Insurance Coverage, Expect your costs to boost when you add your teenager to your car insurance. business insurance. According to, motorists ages 16 to 19 have higher accident prices than all various other motorists.

Insurance coverage. The web site discovered that: Families in California had the greatest rate boosts of more than 200 percent.

Insurance policy business raise prices for teen motorists because of the high rate of major collisions amongst drivers ages 16 to 19 (credit score). Insurance coverage.

In comparison, the ordinary six-month increase to include one more 50-year-old to the same plan is simply $939. Buying a Separate Teenager Policy, Some moms and dads choose to have their teen vehicle driver get a separate policy. While this technique will increase the cost of car insurance for your young driver, it can likewise shield your family members's web well worth if they are at fault in a major mishap.

Little Known Facts About The Cheapest Car Insurance For Teenagers In 2022 - Business ....

Depending upon your state, your teen driver may not be able to show up on the title of an auto and also get independent insurance unless he or she is older than 18. More youthful chauffeurs are also disqualified to sign a lawful contract, which is necessary to acquire car insurance policy coverage. You could desire to take this step if your teenager has a history of crashes or tickets, although you might have to wait until he or she transforms 18.

cheap auto insurance liability cheap auto insurance low cost auto

cheap auto insurance liability cheap auto insurance low cost auto

Conserving Cash on Teenager Auto Insurance, When including your teenager to your policy, shop around to locate a company that offers discount rates for young chauffeurs. Usual alternatives consist of lower costs for university trainees living away from house, children that keep at the very least a B average, and also vehicle drivers who are younger than 18.

Research study from Coverage. com shows that your teen can conserve approximately $361 each year on vehicle insurance, or about 7 percent, with a great driver price cut. You can also conserve if your teen vanishes to university. According to Insurance coverage. com, insurers provide an typical discount rate of $404 a year or regarding 14 percent on vehicle insurance coverage if your kid has a car at your address yet resides in the dormitories or a house and also drives only on college breaks.

Each firm has its very own exclusive pricing framework and provides really various prices from various other firms based upon a selection of variables. You can easily compare rates for the same protection in between insurer with on-line search devices. Inspect this out if you require additional info, sources, or assistance on auto insurance.

You may have the ability to locate even more info about this as well as similar material at piano. affordable. io.

How Insuring A New Teen Driver Doesn't Have To Break The Bank can Save You Time, Stress, and Money.

/african-american-teen-learning-to-drive-with-mom-123133825-580f95893df78c2c73b8c4ac.jpg) cheap car insurance dui trucks vehicle insurance

cheap car insurance dui trucks vehicle insurance

org, agrees."Younger chauffeurs are statistically more probable to be associated with an accident. Teenager drivers are considered risky by insurance companies due to the fact that amateur drivers threaten behind the wheel. Greater costs are passed on to insurance holders as an outcome of the higher risk," she says - car insurance.Car insurance policy for young chauffeurs is pricey, as you'll see in the table listed below, yet you can still save by placing the teenager on your auto insurance coverage policy Check over here as opposed to obtaining him or her their own auto insurance coverage, as well as by garnering all the price cuts you can for young chauffeurs.

"Historic insurance information reveal that teenage child vehicle drivers are more probable to be associated with mishaps as well as Drunk drivings and pay much less interest to the policies of the roadway."Katie Sopko, an insurance agent/agency supervisor with An And also Insurance in Greenville, South Carolina, says statistics reveal male drivers trigger around 6. 1 million crashes each year versus 4.

Obtaining a bargain on teen auto insurance coverage, Our parent overview to insuring a teen provides even more detail, however right here we'll provide the must-know actions to consider maintaining teen chauffeur prices as reduced as feasible. Search, The even more you pay for insurance coverage, the much more likely you can save cash. auto insurance.

It's an excellent idea to inspect quotes for various other cars and truck insurance coverage business when you include a teen vehicle driver to your plan. Including a teen can increase your rates, so make sure you obtain the finest bargain.

As a whole,. You might additionally have the ability to get a multi-driver discount when you add your teen to your policy. low-cost auto insurance."If your kid is presently in college or taking college classes, a lot of service providers will offer a trainee discount rate. And also if your youngster took a protective training course before getting their certificate, most firms will use a discount for this too," Sopko notes.

5 Easy Facts About How To Add A Teen's Car To Your Insurance Explained

"I recommend covering the teen for responsibility only until they have to do with two decades old, which is the age when protection rates have a tendency ahead down - vehicle insurance."Do I need to add my teen to my automobile insurance? State laws vary, so it's suggested that you constantly notify your cars and truck insurer that you have a young driver, but as a whole: All certified drivers in a home requirement to be included to a policy.

Some states permit a licensed teen to be omitted from your policy, but you need to check to see if your insurance policy company also allows it-- few do. Some states permit vehicle insurer to require you to list teens with driving licenses-- so those that are not yet also accredited-- on your insurance coverage. cheap car.

Most states will certainly not enable a teen to title a vehicle in his very own name. Even if your state has no age restrictions on entitling a car, teenager drivers under age 18 are not likely to discover insurance by themselves. It's an agreement, and teens are not old sufficient to sign one (insure).

Far-off pupil, Young person vehicle drivers who reside on university for university or participate in school in another state as well as leave their auto parked at the family members residence may be eligible for a remote student discount rate, states Yoshizawa."Several insurers supply discounts for trainees who live 100 miles away or extra. Integrated with a great trainee discount, this might offer considerable financial savings for family members when it pertains to vehicle insurance policy," Yoshizawa includes (vehicle insurance).

Acquiring a new automobile can also mean cash motivations and also discounts or special leasing prices they can conserve money," Yoshizawa explains."Keep in mind that many vehicle insurance policy plans will certainly allow the group to drive any kind of car in the household - business insurance.

The Best Guide To How To Save On Teenage Drivers Insurance (2022 Guide)

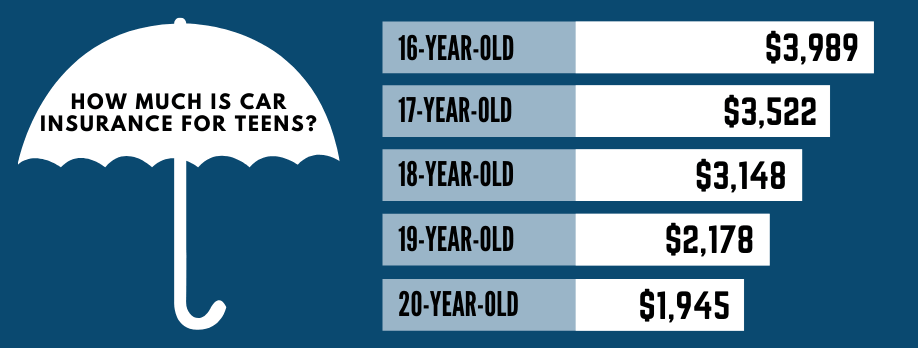

It costs approximately $1,461 each year to add a teenager to your car insurance plan - a rise of 173% contrasted to the ordinary chauffeur's costs - insurance companies. The precise quantity your insurance will increase relies on several elements, consisting of where you live, your driving history, and also your credit report.

Quotes think Geico coverage as well as a 2014 Hyundai Sonata that is shared between the primary policyholder and also the teenager chauffeur. $817 $2,001 $4,801 $836 $2,176 $4,801 $850 $2,259 $4,801 Note: Sample quotes are based on a 16-year-old vehicle driver. Having a young driver on the plan can have drawbacks for the main insurance policy holder.

The majority of car insurer will require young adults who live with parents to be detailed on the parents' policy. If you're a moms and dad of a teenager with a learner's permit, your teenager must be generally covered by your policy without activity needed on your component. As soon as a teen motorist is accredited, you'll require to include them to your policy or prove that they are either guaranteed or completely residing elsewhere.

Just how much will teen cars and truck insurance policy in fact cost you? The expense for insurance will depend on whether your teen will certainly get his/her own insurance or will certainly be included onto yours.

Benefits of Adding a Teenager to Your Policy Adding a teen vehicle driver to an existing policy prices almost half what it would certainly to purchase a private teen automobile insurance coverage plan. Below are some other benefits: This makes it much easier for them to certify for better prices when it is time for them to obtain a plan on their very own.

An Unbiased View of Car Insurance Guide For California Teens - Driversed.com

These higher limits will certainly include any type of teen chauffeur included in the plan, which assists protect moms and dads and teens in the occasion of a crash. When acquiring a vehicle for their teenager, numerous parents anticipate them to acquire and spend for their own insurance coverage. Nonetheless, most are unaware that the name on the insurance coverage need to match the name on the lease/title of the vehicle.

insurance insurance insure cheap insurance

insurance insurance insure cheap insurance

On the occasion that your teen is included in an at-fault mishap or has a relocating violations, you might see an increase in revival rates. This price increase is normally included 2 variables, consisting of: Safe driving discount rate will be gotten rid of, An accident/violation surcharge An additional charge can be as high as 30% per 6 months.

Protection for Your Automobile There are two primary protections that will cover damages to your automobile: Spends for damages if your automobile was associated with a collisionwhether it was with another chauffeur or a solid item. Spends for any type of damages triggered by fire, storm, burglary, and vandalism. Prior to the insurer will reimburse you for any type of damages, an insurance deductible will use.

00 insurance deductible, you will certainly be repaid $2,500. 00. The majority of insurance policy firms offer comprehensive with Full Glass insurance coverage. You do not need to pay an insurance deductible to be repaid for glass damage. The higher deductible you select, the lower your insurance coverage rates will be. Make certain your insurance deductible is within your budget plan in the event a crash happens.

When renting out a car, you do not require to acquire added insurance from the rental company. Your plan will expand to the rental automobile. Finest Firms for Teen Drivers Search and also get quotes from numerous companies to discover the very best rates as well as insurance coverage for your teenager motorist. When including a teen to your plan, search for a company that is financially stable as well as able to pay out on cases.

4 Simple Techniques For Best Car Insurance For Teens - Lendedu

You can conveniently contrast costs and coverage to ensure you are obtaining the very best policy. Our coverage guide describes the different protections to pick from as well as can assist you discover protection that is best for your household - low cost. Ways to Stay Clear Of Insurance Coverage Price Increases This option avoids a rate increase if you have an accident.

Evidence that he/she lives away from home must be sent to your insurance agent. The majority of insurance policy companies will certainly offer an additional discount if your teenager took a Chauffeur's Education and learning program prior to getting his/her permit. This discount rate will generally diminish after your teen has been licensed for 3 years - car. Taking a Defensive Driving course can save motorists as much as 10% on their insurance coverage.