You may want to ask your agent or insurer about a chauffeur exemption endorsement. Can a financing company take out insurance on my automobile and charge me for it? Yes, if under the terms of your loan, you accept supply comprehensive and crash insurance coverage, and you stop working to do so.

These policies usually do not use liability insurance protection to meet the state's financial obligation (compulsory liability) laws. Is it legal for a car insurance provider to position me in a high danger policy if I have not been guaranteed in the last thirty days? Yes. Current Missouri law does not avoid an insurer from doing so.

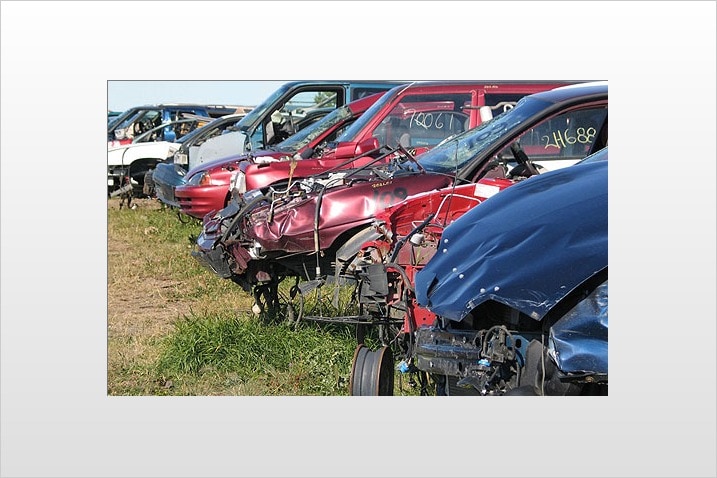

Entering a car wreck can have all sorts of awful consequences, and among the numerous difficulties is having your lorry get totaled. If you drive an older cars and truck, even if you think the mishap you remained in was minor, you may be shocked to discover that your insurance provider states it to be amounted to.

Can an insurance company force you to total your cars and truck? If you disagree with your insurance after an overall loss is stated, you can often challenge it.

The Definitive Guide to My Car Is Totaled - Will Insurance Pay? - Thompson Law Firm

And it's only the case if the car can be fixed at all. Handling the total loss of a car can be a terrible problem, making it tough for a private or a household to get to work, go to school, go grocery shopping, or do any of the things all of us need to do to live our lives.

Postponing only makes it worse. But you likewise don't want to get on the first deal after a total loss. The cars and truck insurance coverage settlement will be as low as they can make it, and you may need to eliminate to get what you actually need. With that in mind, to the best of your capability, try to collect proof after the accident to support your claim.

If you're close adequate to a location you know and trust, have it hauled there to save time. The only way to understand after a total loss that your cars and truck insurance settlement is reasonable is to look up that worth yourself.

Do not forget to keep in mind any improvements you've made that could impact your totaled automobile's value. If you still owe money on the cars and truck, learn the exact quantity you have outstanding. There might effectively be a balance left over, especially if you got the loan just recently, as the ACV is often lower than what you owe due to the fact that of depreciation.

After An Accident - Nc Doi Fundamentals Explained

It might not be so precise who's at fault, and you may require to prove to the insurance coverage company that the other motorist was accountable. That might take a long period of time time you do not have if you need immediate medical treatment or have to secure transport after your automobile was totaled.

You likewise have the alternative of filing a personal injury claim against the at-fault motorist to get compensation that way. Total-loss laws in Oklahoma Oklahoma is an at-fault state, so the insurance coverage company of the driver who triggered the wreck (presuming they're insured according to state law) is supposed to spend for losses of the other drivers included in the accident.

This protection enables you to pay the marketplace price for a new replacement car in the exact same class as the total-loss automobile. Many motorists do not have this choice, however, due to the fact that the premiums on these sort of policies can be substantially greater than basic auto insurance. And it's clear why when you get a typical total-loss car insurance settlement based upon ACV.

Not straight, at least. What might take place, however, is that the mountain of costs that accumulate afterward can damage your credit if they do not earn money. Delinquent medical and automobile repair costs, loans that require to be paid, extra loans that require to be gotten all can be devastating.

The Ultimate Guide To What Happens When Insurance Totals Your Car

Hop in the chauffeur's seat and buckle up as we explain what it means when your automobile is totaled, whether your insurance company will cover an amounted to vehicle and more. What Does It Mean When Your Car Is Totaled? A basic auto insurance coverage policy normally will not pay to fix your cars and truck if it's been amounted to.

Replacement cost refers to what it would cost to acquire a new vehicle equivalent to one that's been amounted to. Your automobile insurance premium will be higher if you go with replacement cost worth coverage instead of real money worth protection.

:max_bytes(150000):strip_icc()/how-long-does-an-insurance-claim-take-527095-v3-5c06f8a4c9e77c0001f50227.png)

When you have a vehicle loan or lease, those two types of protection usually are required. They aren't legal requirements on a vehicle you have actually settled, howeverthe choice to carry comprehensive or crash coverage depends on you. Without protection beyond the liability insurance that's needed in almost every state, you might need to pay out of pocket to replace your amounted to car (particularly if you're at fault in the crash).

Meanwhile, accident insurance applies when your automobile is damaged throughout a crash with another vehicle, a things or home. Sometimes, an insurance provider may not cover a claim when your cars and truck is a total loss. Here are 5 possible factors for your claim being rejected: You lack the appropriate protection, such as detailed or accident.

The smart Trick of Solving Totaled Car Insurance Problems – Forbes Advisor That Nobody is Talking About

Take note that each insurance coverage business uses different criteria for stating that a car is an overall loss. A car that's totaled by one insurance company most likely would be totaled by another.

If you believe your automobile deserves more than the insurer believes it is, you can attempt to work out a higher payment. After your claim is approved, the insurer normally presumes ownership of the amounted to car, which might then be offered for scrap or parts. If you wish to keep your amounted to cars and truck (which's permitted where you live), the insurance company will subtract the salvage value from your claim payout.

Credit report are based entirely on the information in your credit report and don't include things like your driving record or previous insurance claims. To ensure your credit remains unharmed, work carefully with your insurance provider and your loan provider to make certain the loan covering the car is properly paid off and closed.

While an accident won't damage your credit report, it can impact your automobile insurance coverage premium, even if your automobile is amounted to after a mishap. You may be able to prevent this if you receive accident forgiveness coverage, but that advantage isn't readily available in every state or from every insurance provider.